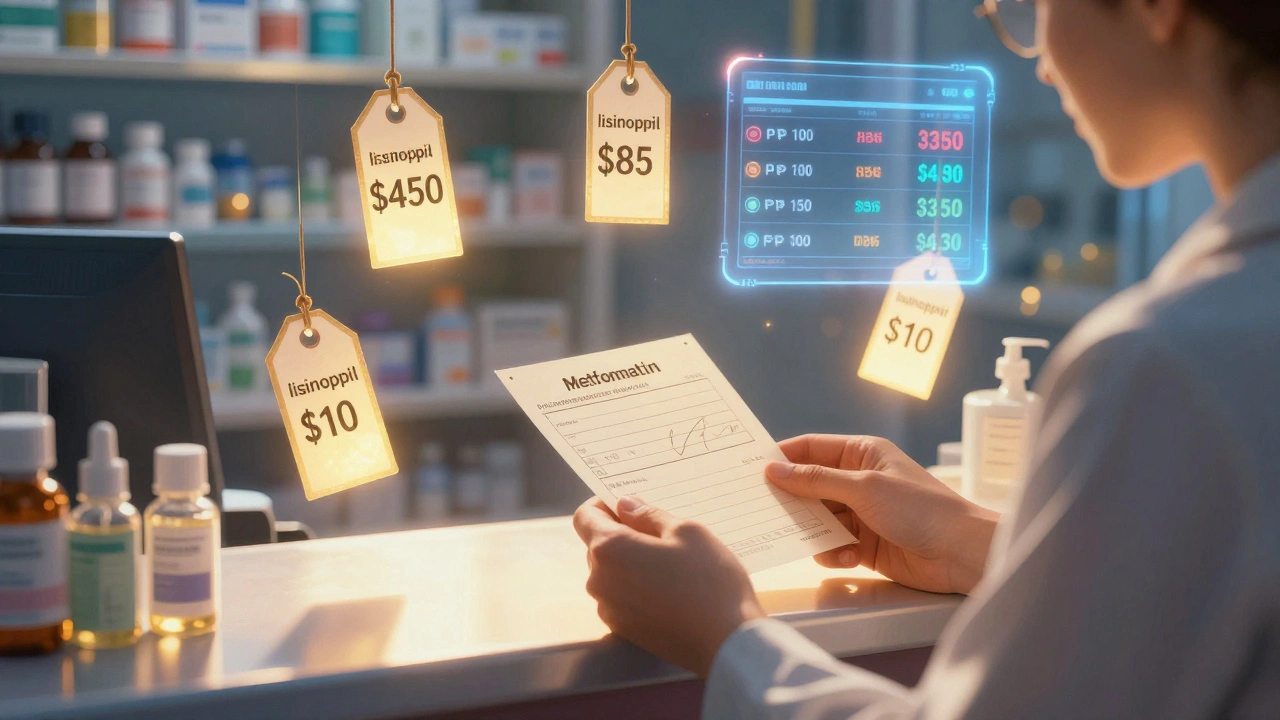

Getting a prescription filled shouldn’t feel like a guessing game. One pharmacy charges $450 for your medication. Another down the street wants $85. Same drug. Same dosage. Same insurance. What’s going on? You’re not alone. In 2025, it’s still common for patients to pay over 500% more than necessary just because they didn’t know where to look. That’s where price transparency tools come in - and they’re easier to use than you think.

Why Drug Prices Vary So Much

Pharmacy prices aren’t set by law. They’re negotiated between your insurance company, the pharmacy, and sometimes even the drug manufacturer. That means two identical prescriptions can cost wildly different amounts - even at stores right next to each other. A 30-day supply of metformin might be $10 at Walmart, $42 at CVS, and $18 at a local independent pharmacy. Why? Because each one has a different deal with your insurer. Without a tool to show you these differences, you’re stuck paying whatever the first pharmacy tells you.What Are Price Transparency Tools?

These are free online or app-based platforms that pull real-time data from your insurance plan and local pharmacies to show you exactly how much you’ll pay out-of-pocket for a drug. They don’t show list prices - the inflated numbers drug companies publish. They show what your plan actually pays and what you owe. The federal government forced insurers to build these tools starting in 2023. If you have employer-sponsored insurance, your plan likely already has one built in. You just need to know where to find it.Top Tools You Can Use Right Now

Not all tools are created equal. Here are the most reliable ones, based on real user data and expert reviews:- Rx Savings Solutions (RxSS): This one focuses on drugs. It scans your prescription and finds cheaper alternatives - sometimes generic versions or different brands that work the same. In 2023, it found cost-saving options for 83% of users. It integrates with 18 of the top 25 pharmacy benefit managers, so if your insurer uses one of them, you’re covered.

- Optum Rx: If your employer uses UnitedHealthcare or a related plan, you probably have access to myCompass. Click "Go to Optum Rx" and enter your drug name. It shows prices at pharmacies within 10 miles and even suggests mail-order options that can cut your monthly bill in half.

- FAIR Health Consumer: This tool doesn’t need your insurance login. Just type in the drug name and your zip code. It pulls data from over 300 million claims and shows you what others with similar plans paid. Great for checking prices before you even call a pharmacy.

- Turquoise Health: Used by hospitals and insurers, but also available to consumers. It’s more detailed than most, letting you filter by pharmacy type, delivery speed, and even whether a drug requires prior authorization.

- Healthcare Bluebook: Best for procedures, but it also covers over 4,000 prescriptions. It shows a "Fair Price" benchmark so you know if you’re being overcharged. Users have saved up to $3,000 on single prescriptions using this tool.

How to Use Them (Step by Step)

You don’t need to be a tech expert. Here’s how to save money in five simple steps:- Check if your insurer has a tool. Log into your insurance portal. Look for tabs like "Drug Costs," "Price Estimator," or "Pharmacy Savings." If you’re not sure, call customer service and ask: "Do you have a tool to compare prescription prices?" About 78% of large employers now offer one.

- Enter your exact drug details. Type in the full name (e.g., "lisinopril 10 mg tablet"), not just "blood pressure pill." Include the dosage and quantity (e.g., 30 tablets, 90-day supply). Small differences matter.

- Compare prices across pharmacies. The tool will show you a list of nearby locations with their prices. Pay attention to the "Your Cost" column - that’s what you pay after insurance. Don’t just pick the lowest list price. Sometimes the cheapest list price means you pay more out-of-pocket.

- Ask for alternatives. Tools like RxSS will suggest cheaper drugs that treat the same condition. For example, switching from brand-name atorvastatin to generic simvastatin can cut your cost from $120 to $12 per month - with the same effect. Always check with your doctor before switching.

- Call the pharmacy before you go. Even the best tools can be off by a few dollars. Call ahead with your insurance ID and ask: "What’s my out-of-pocket cost for [drug name] right now?" This catches any last-minute changes in your plan or pharmacy discounts.

Real People, Real Savings

One user on Reddit saved $287 on a 90-day supply of apixaban - a blood thinner - just by switching from CVS to a local pharmacy using RxSS. Another person cut their annual drug spending from $1,850 to $620 by using Optum Rx to find mail-order options and generic switches. A Kaiser Health News report showed a patient reducing an MRI bill from $4,200 to $450 using Healthcare Bluebook. These aren’t outliers. They’re what happens when people stop accepting the first price they’re given.What These Tools Don’t Tell You

They’re powerful, but not perfect. Here’s what to watch out for:- They don’t always include GoodRx coupons. Some tools show only insurance-based pricing. Always check GoodRx or SingleCare separately - they often have lower cash prices than your insurance copay.

- Some tools show list prices, not your cost. If you see a price like "$1,200" and your plan says you pay "$35," make sure the tool is showing your actual out-of-pocket cost. If it’s not, you’re looking at the wrong one.

- Specialty drugs are tricky. Medications for cancer, MS, or rheumatoid arthritis often need prior authorization. These tools might not show prices until your insurer approves them. Still, use them to estimate what approval might cost.

- Timing matters. Prices can change daily. A tool might show $15 today and $22 tomorrow. If you’re not in a rush, wait a few days. Sometimes prices drop after a new batch arrives.

What’s Changing in 2025

The rules are getting stricter. By 2025, all price transparency tools must include quality ratings alongside prices - so you can see not just how much something costs, but how well it works. New tools are being built with AI that predicts your future costs based on your medication history. The Alliance for Transparent Drug Pricing, formed in May 2024, includes giants like UnitedHealthcare and Express Scripts. They’re working to make pricing data consistent across platforms so you don’t get five different numbers from five different apps.What You Should Do Today

If you take even one prescription, spend 10 minutes right now:- Log into your insurance account.

- Find the drug cost tool.

- Search for your most expensive medication.

- Compare prices at three nearby pharmacies.

- Check if a generic or alternative exists.

Do price transparency tools work for all medications?

Most tools cover over 90% of common prescriptions, including generics and brand-name drugs. But specialty medications - like those for cancer, autoimmune diseases, or rare conditions - often require prior authorization, and prices may not appear until your insurer approves them. Even then, these tools can still show you estimated costs and suggest alternatives that might be covered more easily.

Can I use these tools if I don’t have insurance?

Yes. Tools like FAIR Health Consumer and GoodRx don’t require insurance. Just enter your drug name and zip code. They’ll show you cash prices from nearby pharmacies. In many cases, the cash price is lower than your insurance copay - especially for generic drugs. Always compare cash prices with insurance prices to find the best deal.

Why does the price at the pharmacy sometimes differ from the tool?

Prices can change due to timing. Insurance claims might not update in real time, or the pharmacy might have run out of a discounted batch. Some tools don’t include pharmacy loyalty discounts or coupons. Always call the pharmacy before picking up your prescription to confirm the final price. It takes 30 seconds and can save you money.

Are these tools safe to use with my personal info?

Tools provided by your insurer or major health tech companies (like Optum Rx or FAIR Health) are HIPAA-compliant and secure. Never enter your insurance details on a site you don’t recognize. Stick to official portals from your health plan or well-known platforms. Avoid third-party apps asking for your Social Security number or full insurance card.

Can I use these tools to compare prices for my family?

Yes. If your family is on the same insurance plan, you can search for each person’s prescriptions using the same tool. Some platforms even let you add multiple members to your account. If family members have different plans, you’ll need to check each plan’s tool separately. It’s worth the extra time - savings add up fast when you’re managing multiple prescriptions.

Do these tools work with Medicare?

Yes. Medicare Part D plans are required to offer price comparison tools. Log into your Medicare plan’s website or use the Medicare Plan Finder tool at medicare.gov. You can compare costs across different Part D plans and pharmacies. Many seniors save hundreds per year just by switching pharmacies or choosing a different Part D plan during open enrollment.

What if my doctor says I can’t switch to a cheaper drug?

Doctors usually agree to switches if the alternative is clinically equivalent. If your tool suggests a cheaper drug, bring it up with your doctor. Say: "I found this generic version that costs $15 instead of $120. Is it safe for me?" Most doctors are open to it - especially if the cheaper option has the same FDA approval and effectiveness. If your doctor refuses, ask for the reason. Sometimes it’s outdated info or habit, not medical necessity.